Main consolidated economic and financial results for the first half of 2020:

- Net revenues of 38.2 million Euros, with a 19,7% increase on the first half of 2019;

- Gross Margin equal to 48,4% of revenues, improving of 450 basis points year-on-year;

- EBITDA reaching 7.5 million Euros with a 64,9% growth year-on-year and with an improved incidence on revenues of 19,6%, improving of 540 basis points year-on-year;

- Pre-tax profit increases by 42% year-on-year, equal to 4.8 million Euros compared to 3.4 million Euros in the first half of 2019;

- Net financial debt of 8.7 million Euros, substantially stable compared to 8.2 million Euros at December 31st, 2019.

Arezzo, Italy – September 16th 2020 – The Board of Directors of SECO SpA, a company established by Daniele Conti and Luciano Secciani in 1979, a leading high-tech manufacturer of computer miniaturization and “ready-to-use” IoT integrated systems, with shareholder FII Tech Growth fund backed by Cassa Depositi e Prestiti, gathered today and approved economic and financial data for the first half of 2020, prepared according to OIC domestic accounting standards and not yet subject to audit. The Board of Directors also positively acknowledged the progress made on the project to go public on the STAR segment of Borsa Italiana (Milan Stock Exchange) recently approved.

“The excellent results of the first half of 2020, achieved despite the difficulties of the economic context that we all know, confirm the solidity of SECO Group’s competitive positioning and the validity of the strategy currently being implemented.” said Massimo Mauri chief executive officer of SECO SpA, “The outlook for the coming quarters is positive and will be supported by new growth initiatives both organic and through external activities aimed at further strengthening the Group also in view of the listing on the stock exchange, that we expect to take place in 2021. We are also proud – Mauri continued – not only to have maintained employment levels but to have continued to hire highly qualified personnel in such a difficult time for the Italian economy.”

ANALYSIS OF THE GROUP'S ECONOMIC AND FINANCIAL MANAGEMENT IN THE FIRST HALF OF 2020

In the first half of 2020 consolidated revenues reached 38.2 million Euros, with a 19,7% increase compared to the same period of 2019, thus confirming the growth trend from the previous years.

Margins grew more than proportionally thanks to the focus on greater value-added products and more profitable end markets. Gross margin was equal to 48.4% of revenues, with an improvement of 450 basis points year-on-year, and EBITDA margin had an incidence on revenues of 19,6%, improving of 540 basis points year-on-year. In absolute value EBITDA reached 7.5 million Euros in the first half of the year, up by 64,9% compared to the same period of 2019.

The growth of the pre-tax Profit was also remarkable, which increased by 42% year-on-year reaching 4.8 million Euros.

The evolution of the Net Financial Debt of 8.7 million Euros at the end of June 2020 is under control and substantially stable compared to 8.2 million Euros at December 31st, 2019 despite the ongoing investment plans in tangible and intangible assets, the finalization of the acquisition of InHand Electronics in the United States and the increase in stock of raw materials in preparation to the launch of new products in the second half of the year.

OUTLOOK FOR THE SECOND HALF OF 2020

The outlook for the second half of 2020 is positive both in terms of growth in sales of embedded products, the historical core-business of the group, and the beginning of the commercialization of Biorespira, the innovative non-invasive pulmonary ventilator conceived for Covid patients and patients affected by respiratory diseases. Regarding the Internet of Things services and solutions, the recent acquisition of Ispirata, a data orchestration company, together with further ongoing initiatives is expected to generate additional growth opportunities.

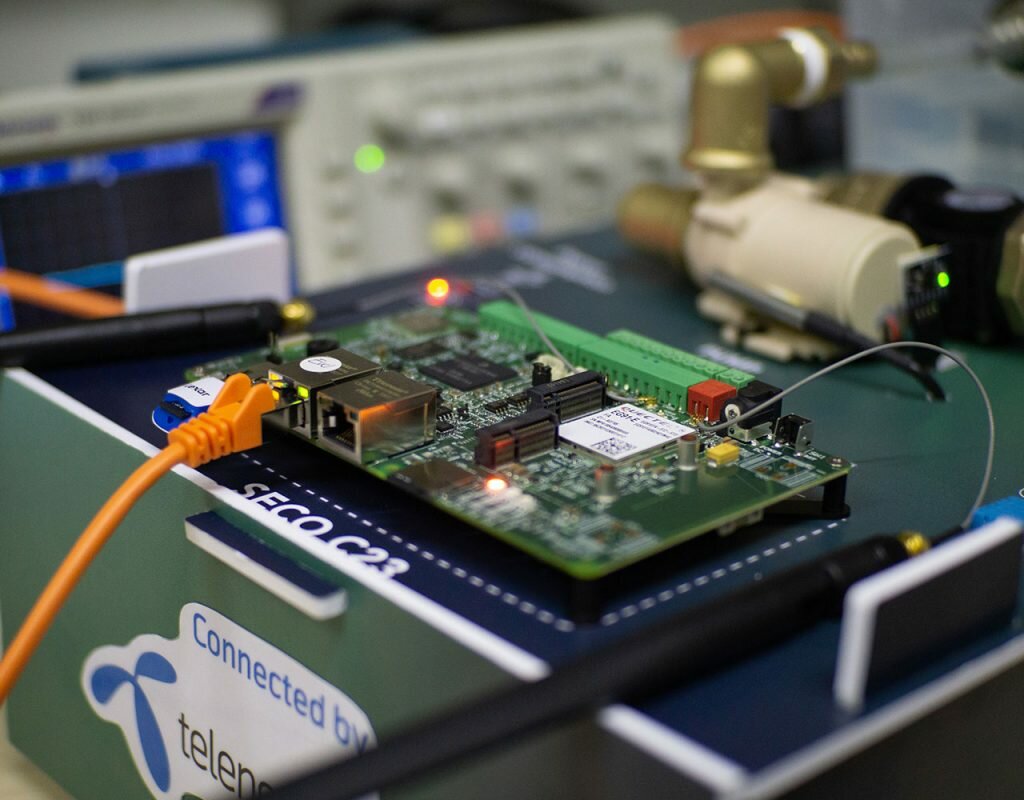

SECO

SECO is an Italian group with a leading global position in the sector of embedded technology and Internet of Things (IoT). Since 1979, it has been designing and producing embedded systems – industrial computers that are integrated into a client’s machine or tool, activating its functions and permitting interaction through touch/video interfaces. SECO collaborates with a broad network of strategic suppliers in the international high-tech panorama (including Intel®, AMD, NXP, NVIDIA®, Wind, and Telenor), as well as with universities, research centers and innovative start-ups, and operates on a global scale with offices in Italy, Germany, the U.S., India and Taiwan, employing more than 380 people. The industrial sectors in which SECO products are utilized range from biomedicine to wellness, industrial automation to transportation, and it has clients that are market leaders, such as Cimbali, Esaote, Evoca, and Technogym. Participated by Fondo Italiano Tecnologia e Crescita managed by Fondo Italiano d'Investimento SGR, in 2019 SECO further expanded its reach by completing two important acquisitions. It strengthened its investments in research and development and production capabilities in China by acquiring a majority stake in Fannal Electronics CO. Ltd. In the United States it acquired 100% of InHand Electronics, based in Maryland, a leading provider of low-power rugged embedded systems and software to original equipment manufacturers of handheld, portable, Internet of Things (IoT), and wireless devices for the military/defense, industrial, medical, transportation and infotainment markets. To complete its IoT technology/ product portfolio, in July 2020 SECO acquired Ispirata, a start-up that provides integrated solutions to companies entering the IoT/ Embedded world, accessible and ready-to-use for optimized data field management. For more information www.seco.com

Fondo Italiano Tecnologia e Crescita

Fondo Italiano Tecnologia e Crescita is an equity fund managed by Fondo Italiano d’Investimento SGR and is dedicated to invest in the growth of companies with high-tech business models. The fund announced its first closing in September 2017 with Cassa Depositi e Prestiti as cornerstone investor. Fondo Italiano d'Investimento SGR currently manages a total of eight investment funds, dedicated to institutional investors, for a total of about Euro 3 billion of Assets Under Management. For more information: www.fondoitaliano.it

**NOT FOR PUBLICATION, DISTRIBUTION OR RELEASE IN OR INTO THE UNITED STATES OF AMERICA, THE UNITED KINGDOM, CANADA, AUSTRALIA, OR JAPAN **

NOT FOR DISTRIBUTION, DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED STATES OR TO “U.S. PERSONS” (AS DEFINED IN REGULATION S UNDER THE U.S. SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”)), THE UNITED KINGDOM, CANADA, AUSTRALIA, JAPAN OR ANY OTHER JURISDICTION WHERE TO DO SO WOULD BE UNLAWFUL

The distribution of this press release, directly or indirectly, in or into the United States, the United Kingdom, Canada, Australia or Japan is prohibited. This press release (and the information contained herein) does not contain or constitute an offer of securities for sale, or solicitation of an offer to purchase securities, in the United States, the United Kingdom, Canada, Australia or Japan or any other jurisdiction where such an offer or solicitation would require the approval of local authorities or otherwise be unlawful (the “Other Countries”). The securities referred to herein have not been and will not be registered under the U.S. Securities Act of 1933, as amended (the “Securities Act”), or pursuant to the corresponding regulations in force in the Other Countries and may not be offered or sold in the United States unless the securities are registered under the Securities Act, or an exemption from the registration requirements of the Securities Act is available.

SECO does not intend to register any portion of the offering of the securities referenced in this press release in the United States or to conduct a public offering of the securities in the United States. Any public offering of securities to be made in the United States will be made by means of an offering memorandum that may be obtained from the Company and will contain detailed information about the company and management, as well as financial statements.

This communication does not constitute an offer of the securities to the public in the United Kingdom. No prospectus has been or will be approved in the United Kingdom in respect of the securities. This communication is being distributed to and is directed only at (i) persons who are outside the United Kingdom or (ii) persons who are investment professionals within the meaning of Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “Order”) and (iii) high net worth entities, and other persons to whom it may lawfully be communicated, falling within Article 49(2)(a) to (d) of the Order (all such persons together being referred to as “Relevant Persons”). Any investment activity to which this communication relates will only be available to and will only be engaged with, Relevant Persons. Any person who is not a Relevant Person should not act or rely on this document or any of its contents.

Contacts:

SECO SpA

Simona Agostinelli

Marketing Communications Director

Tel. +39 0575 26979

COMMUNITY COMMUNICATIONS ADVISERS

Tel. +39 3357357146

zh

zh